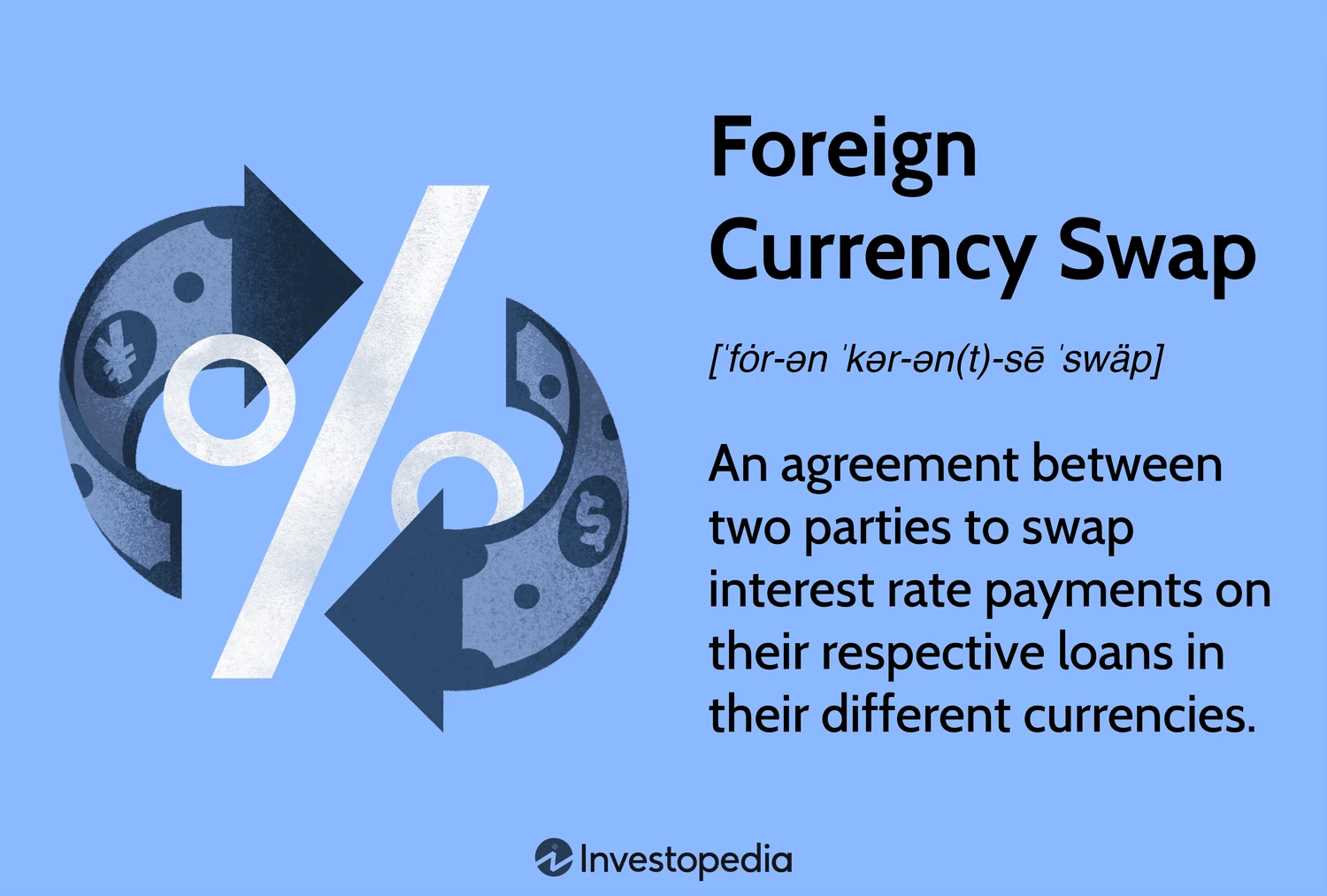

What Is a Foreign Currency Swap?

A foreign currency swap refers to an agreement between two parties from different countries to exchange interest payments on loans in different currencies.

Besides interest payments, a foreign currency swap may involve exchanging principal amounts, which are usually returned to their original owners at the agreement’s end. Often, these swaps revolve around notional principal used for interest calculations, not actual exchange.

Key Takeaways

- Foreign currency swaps allow parties to exchange interest rate payments on loans denominated in different currencies.

- They can involve the swap of principal amounts.

- The main types include fixed-for-fixed and fixed-for-floating rate swaps.

- Companies can benefit from lower borrowing costs and hedge against exchange rate fluctuations.

Understanding Foreign Currency Swaps

Currency swaps are often used to access foreign currency loans at more favorable rates compared to local borrowing.

During the 2008 financial crisis, the Federal Reserve provided currency swap options to aid developing nations facing liquidity challenges.

Notably, the first currency swap occurred in 1981 between the World Bank and IBM, facilitated by Salomon Brothers.

Currency swaps can have maturities extending up to a decade and involve principal exchanges unlike interest rate swaps.

The Process of a Foreign Currency Swap

In a foreign currency swap, parties pay interest on each other’s loan principal amounts throughout the agreement. Principal exchanges occur at the end of the swap period at an agreed or spot rate to mitigate transaction risks.

Currency swaps have historically been linked to the London Interbank Offered Rate (LIBOR) but are transitioning to the Secured Overnight Financing Rate (SOFR) as a benchmark from 2023 onwards.

Types of Swaps

The two primary types of currency swaps are fixed-for-fixed and fixed-for-floating rate swaps, involving fixed or floating interest payments exchanges.

Whereas fixed-for-fixed swaps include fixed interest payments in both currencies, fixed-for-floating swaps involve exchanging fixed interest in one currency for floating interest in another without principal exchange.

Foreign currency swaps facilitate global economic transactions by providing cost-effective borrowing options and risk management solutions to businesses and governments.

Reasons for Using Currency Swaps

Decreasing Borrowing Costs

Currency swaps are commonly used to secure loans at lower interest rates. For example, companies can borrow in different currencies at more favorable rates by engaging in swaps.

Principal exchanges, if involved, are typically reversed at the swap’s maturity.

Reducing Exchange Rate Risks

Institutions utilize currency swaps to mitigate potential losses from exchange rate fluctuations. By hedging currency risks, companies can offset losses resulting from adverse exchange rate movements.

For instance, U.S. and Swiss companies can enter into swaps to protect against fluctuations in USD and Swiss franc exchange rates, thereby safeguarding their financial positions.

When the need for hedging diminishes, parties can unwind the swap. Any losses incurred due to exchange rate variations can be mitigated by gains from the swap.

Why Do Companies Do Foreign Currency Swaps?

Foreign currency swaps serve two essential purposes. They offer a company access to a loan in a foreign currency that can be less expensive than when obtained through a local bank. They also provide a way for a company to hedge (or protect against) risks it may face due to fluctuations in foreign exchange.

What Are the Different Types of Foreign Currency Swaps?

Foreign currency swaps can involve the exchange of fixed rate interest payments on currencies. Or, one party to the agreement may exchange a fixed rate interest payment for the floating rate interest payment of the other party. A swap agreement may also involve the exchange of the floating rate interest payments of both parties.

When Did the First Foreign Currency Swap Occur?

The first foreign currency swap is purported to have taken place in 1981 between the World Bank and IBM Corporation.