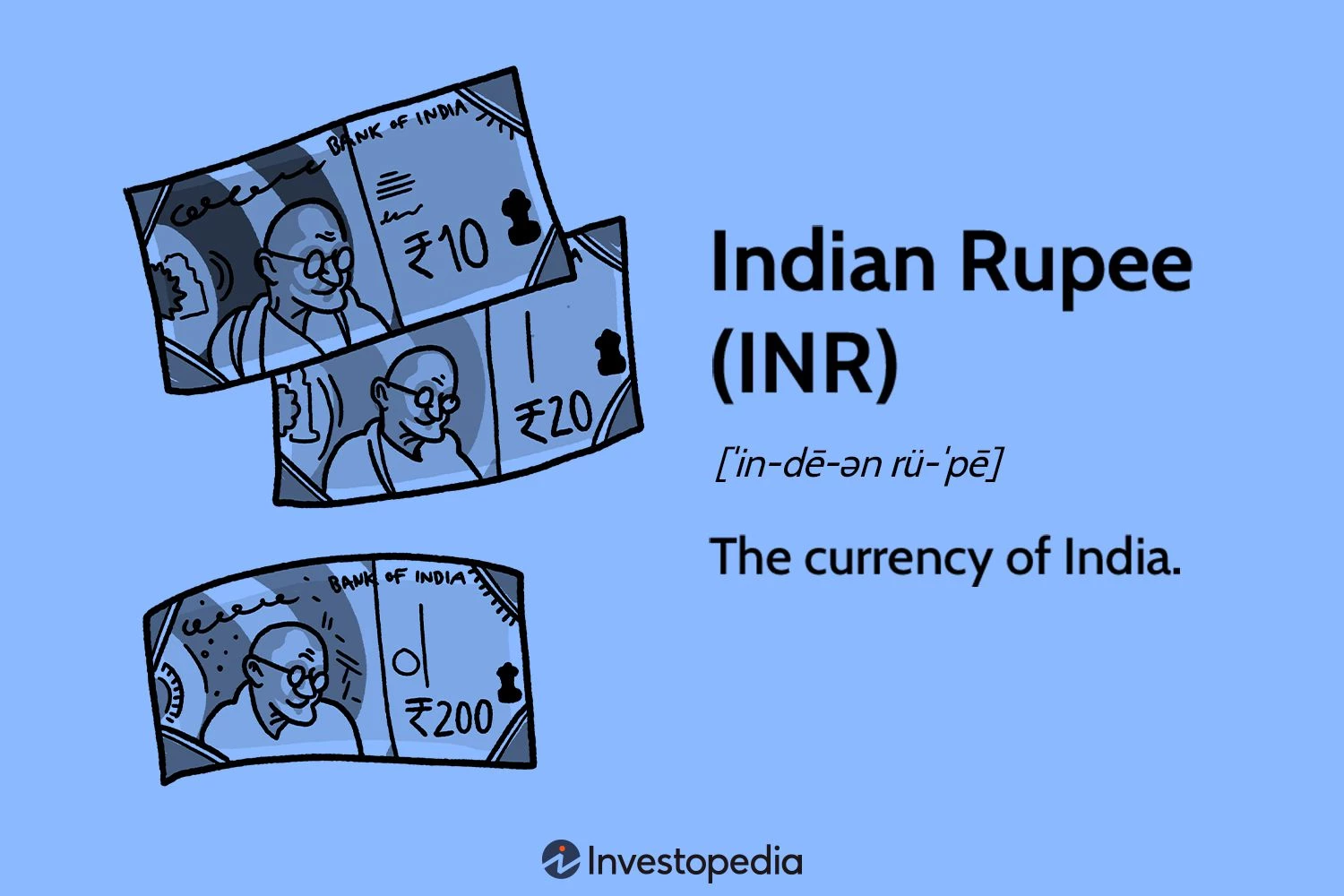

What Is the Indian Rupee (INR)?

The Indian Rupee (INR) serves as the official currency of India, recognized by the International Organization for Standardization (ISO) with the currency code INR. Symbolized by ₹, the Indian Rupee holds significance in the country’s economic landscape.

Key Takeaways

- The Indian Rupee, denoted by INR, is the currency of India, distinguished by the symbol ₹.

- India’s cash-centric economy has encountered issues with counterfeit currency circulating unlawfully.

- To combat currency fraud, the Reserve Bank of India consistently updates rupee notes with enhanced security features.

- Factors like trade flows, investment patterns, and oil prices play a pivotal role in shaping the Indian Rupee’s exchange rate.

Understanding the Indian Rupee (INR)

The Indian Rupee derives its name from the historic rupiya, a silver coin initially issued by Sultan Sher Shah Suri in the 16th century.

Coins

Coins in India manifest in multiple denominations, including 50 paise, one rupee, two rupees, five rupees, ten rupees, and 20 rupees. Notably, 50 paise coins fall under the category of small change, while those equivalent to or exceeding one rupee are categorized as rupee coins.

Banknotes

Banknotes in India come in various denominations like 5, 10, 20, 50, 100, 500, and 2,000 rupees. The reverse side of these notes features multiple languages, whereas Hindi and English appear on the front side. The Reserve Bank of India periodically updates banknote designs to portray themes reflective of India’s rich history and heritage.

Security and Counterfeiting of the Rupee

India’s reliance on cash transactions has facilitated the circulation of counterfeit currency by illicit entities. To mitigate this issue, the Reserve Bank of India has continuously introduced new security features in rupee notes. Counterfeit money poses a threat, with high-denomination notes being particularly vulnerable to replication.

In a significant move, the Indian government announced the demonetization of ₹500 and ₹1,000 banknotes to disrupt underground economic activities supported by counterfeit currency. This initiative aimed to thwart illegal financing and terrorist activities, subsequently introducing new notes with advanced security measures in the Mahatma Gandhi Series.

Special Considerations: Capital and Convertibility Controls

Over time, the Indian Rupee has been subject to varying capital controls and convertibility restrictions. Foreign nationals are prohibited from importing or exporting rupees, while Indian citizens face limitations on currency movements.

A country’s current account, encompassing savings, investment flows, and trade balances, forms the core of its economic structure. India’s current account maintains no stringent currency conversion regulations, except for trade-related barriers.

The capital account tracks foreign reserves, business activities, and institutional investments. The Indian government leverages flexible restrictions on foreign investments to balance the capital account effectively. Recent relaxations aim at bolstering the currency exchange rate and fostering business investments in the nation.

The Rupee’s Value in Modern Times

Throughout history, the rupee’s value has fluctuated due to numerous factors, including global economic shifts and financial policies. From being pegged to the British pound and later the US dollar, the Indian Rupee now predominantly floats in the foreign exchange market. The Reserve Bank of India actively engages in currency trading to regulate its value.

Various factors, such as trade dynamics, investment trends, and oil prices, significantly influence the currency exchange rate. Notably, India’s reliance on oil imports exposes the economy to potential inflation risks, prompting intervention from the Reserve Bank of India to stabilize economic conditions.

Examples of the Indian Rupee (INR)

As of March 2024, the Indian Rupee circulates in various coin and note denominations including 50 paise coin, ₹1, ₹2, ₹5, ₹10, and ₹20 coins, as well as ₹2, ₹5, ₹10, ₹20, ₹50, ₹100, ₹200, ₹500, and ₹2,000 banknotes.

Updates regarding the legal tender status of specific coins and notes issued by the Reserve Bank of India are available on their official website.

Example of Coins and Banknotes for the Indian Rupee. Investopedia

What Is the Indian Rupee Symbol?

The distinct currency symbol ₹ signifies the Indian Rupee (INR), selected through a public competition and endorsed by the Indian government in 2010.

What Does Rs Stand for in Money?

The currency abbreviation “Rs” is commonly used for currency representation in diverse regions like the Seychelles, Pakistan, Nepal, Sri Lanka, and Mauritius. It was prevalent in India before the adoption of the current Indian Rupee symbol ₹ in 2010.

Is the Indian Rupee Backed by Gold?

Banknotes issued by the Reserve Bank of India maintain backing through assets like gold, government securities, and foreign currency reserves.

The Bottom Line

The Indian Rupee functions as the national currency of India, identified by the currency code INR and represented by the symbol ₹. The Reserve Bank of India supervises the issuance of coins and notes across various rupee denominations, ensuring the stability and integrity of the monetary system.

The prevalence of counterfeit currency poses challenges within India’s cash-driven economy, prompting continuous efforts by the Reserve Bank to fortify rupee notes with advanced security features against fraudulent activities.